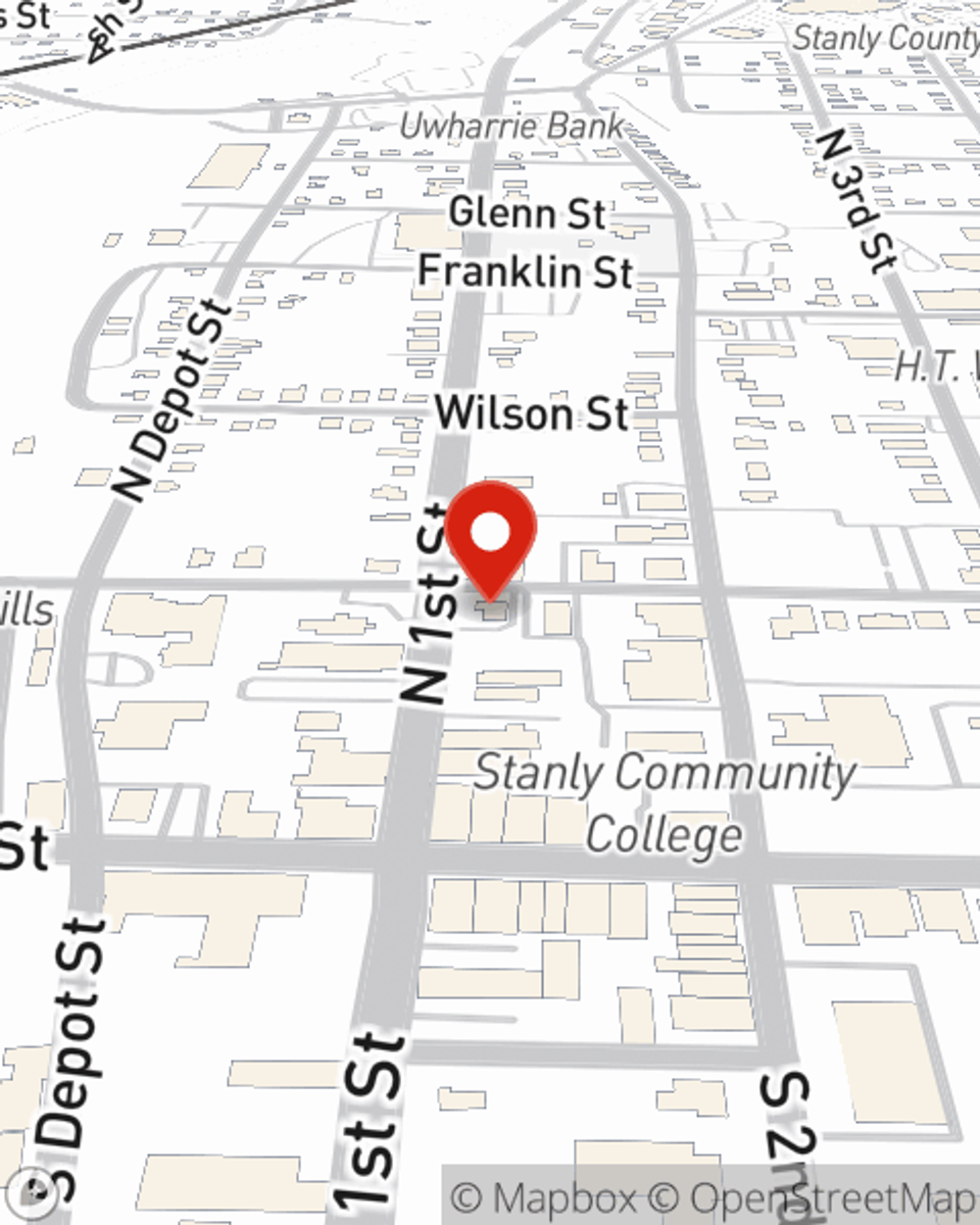

Business Insurance in and around Albemarle

One of the top small business insurance companies in Albemarle, and beyond.

Helping insure businesses can be the neighborly thing to do

- Concord

- Kannapolis

- Salisbury

- Locust

- Oakboro

- Mount Gilead

- New London

- Midland

- Harrisburg

- Mint Hill

- Charlotte

- Huntersville

- Anson County

- Norwood

- Albemarle

- Rowan County

- Montgomery County

- Cabarrus County

- Stanly County

- Thomasville

- Lexington

- Union County

- Monroe

- Sun Valley

Cost Effective Insurance For Your Business.

Preparation is key for when something unavoidable happens on your business's property like a customer hurting themselves.

One of the top small business insurance companies in Albemarle, and beyond.

Helping insure businesses can be the neighborly thing to do

Protect Your Future With State Farm

With State Farm small business insurance, you can give yourself more protection! State Farm agent Eddie Wall is ready to help you prepare for potential mishaps with dependable coverage for all your business insurance needs. Such attentive service is what sets State Farm apart from other business insurance providers. And it won’t stop once your policy is signed. If the unexpected happens, Eddie Wall can help you file your claim. Keep your business protected and growing strong with State Farm!

Take the next step of preparation and visit State Farm agent Eddie Wall's team. They're happy to help you explore the options that may be right for you and your small business!

Simple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

Eddie Wall

State Farm® Insurance AgentSimple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.